In this article we delve into the world of VAT invoices and answer some of the most common questions we receive here at Chapman Robinson & Moore.

We’ll explain the purpose of a VAT invoice, when it should be issued, and the requirements and validity of a VAT invoice. So, let’s get started!

What is a VAT invoice?

A VAT invoice includes a breakdown of the VAT charged on the goods or services provided. This allows businesses to claim input tax credits (VAT paid on business expenses) and calculate their VAT liability.

When you provide goods or services that are subject to standard-rated or reduced-rated VAT to another individual or business that is registered for VAT, you need to provide them with a VAT invoice.

However, it is not required to issue VAT invoices for supplies that are zero-rated. In such cases, VAT is charged at a rate of 0%, and therefore, a VAT invoice is not necessary.

There is also no obligation to issue VAT invoices for supplies made to customers who are not registered for VAT.

In practical terms, this often means that you would issue a VAT invoice to any customer who requests one, as it is not always easy to determine whether they are VAT registered or not.

You are not required to verify a customer’s VAT registration status before issuing a VAT invoice.

Furthermore, a VAT invoice acts as a supporting document for audits, ensuring transparency and accountability in financial transactions.

What is the difference between a VAT invoice and a normal invoice?

Put simply, a VAT invoice includes VAT charges on taxable supplies, whereas a normal invoice is used for non-VAT transactions or transactions that are exempt from VAT.

Reasons for Issuing a VAT Invoice

As a registered VAT business, issuing VAT invoices is a legal requirement.

Failing to provide a VAT invoice where applicable may result in penalties or disputes with HMRC.

Additionally, VAT invoices help maintain proper records, facilitating accurate financial reporting and enhancing credibility with clients and suppliers.

When should a VAT invoice be issued?

It is crucial to provide VAT invoices in a timely manner to ensure compliance and avoid any delays or complications.

Issuing VAT invoices is subject to a strict time limit. Generally, you are required to issue a VAT invoice to a VAT-registered customer within 30 days from the date of supplying the goods or services.

If you received payment in advance, the invoice should be issued within 30 days from the date of receiving payment.

By providing the invoice on time, your customer can claim the VAT on the supply, provided they are eligible to do so.

It is important to note that issuing invoices beyond the 30-day limit requires permission from HM Revenue and Customs (HMRC), except in a few specific circumstances which include:

- Awaiting VAT Invoices

If you are awaiting VAT invoices from your own suppliers or subcontractors, you can extend the 30-day limit until you receive the necessary documentation. - Previously Approved Extension

If an extension of the 14-day limit has already been approved, you can utilise that extension without the need for further approval. - Approved Special Accounting Arrangements

If you have special accounting arrangements in place that have been approved by HMRC, you can follow the specific time limits outlined in those arrangements. - Newly Registered but Unnotified VAT Registration Number

In cases where you are newly registered for VAT but have not yet received notification of your VAT registration number, you must issue the VAT invoice within 30 days from the date you receive advice of the VAT registration number.

By adhering to the time limits for issuing VAT invoices, or seeking appropriate extensions when necessary, you can ensure compliance with VAT regulations and maintain accurate records of your transactions.

When is it not necessary to issue a VAT invoice?

There are certain circumstances where issuing a VAT invoice is not required. These include

- Self-billing Arrangements

If your customer operates self-billing arrangements as outlined in the Self-billing (VAT Notice 700/62), you are not obligated to issue a VAT invoice. Similarly, if you provide authenticated receipts, a separate VAT invoice is not necessary.

- Gift of Goods

In cases where you make a gift of goods that are subject to VAT, you are not required to issue a VAT invoice.

Additionally, there are specific scenarios where VAT invoices should not be issued for goods sold under the VAT second-hand schemes. The special invoices to be used in these cases can be found here, and include:

– VAT Margin Schemes. This is where you pay VAT at 16.67% (one-sixth) on the difference between what you paid for an item and what you sold it for, rather than the full selling price.

– Using the VAT Margin Scheme for Second-Hand Vehicles

– Using the Auctioneers’ VAT Margin Scheme

Who is responsible for paying a VAT invoice?

The responsibility for paying a VAT invoice lies with the recipient of the goods or services, commonly known as the customer or client.

When a VAT invoice is issued, it outlines the amount of VAT charged, which the customer is required to pay.

The VAT collected by the supplier is later remitted to the tax authorities as part of their VAT liability.

It is important for businesses to clearly communicate and enforce their payment terms to ensure the timely settlement of VAT invoices.

Is a VAT invoice a receipt?

While a VAT invoice contains details similar to a receipt, it is not technically a receipt.

A VAT invoice provides a comprehensive breakdown of the transaction, including the VAT charged, while a receipt typically acknowledges the payment made by the customer.

However, in certain cases, a VAT invoice can also serve as proof of payment when it includes the payment details.

What are the different types of VAT invoice?

Depending on the nature of the transaction, various types of VAT invoices may exist.

Common types include standard invoices, modified invoices, simplified invoices (for smaller transactions), self-billing invoices (issued by the customer), and pro forma invoices (issued before the actual supply of goods or services).

- Full VAT Invoice

A full VAT invoice is used for various types of transactions and contains comprehensive details.

- Modified VAT Invoice

Modified VAT invoices are specifically used for retail supplies that exceed a total value of £250. These invoices ensure clarity and transparency in transactions involving higher amounts.

- Simplified VAT Invoice

Simplified VAT invoices are applicable for retail supplies that have a total value below £250.

They provide a streamlined version of the invoice and only require essential details.

These invoices simplify the documentation process for smaller transactions while meeting VAT requirements.

What are the requirements of a VAT invoice?

To ensure the validity and compliance of a VAT invoice, several requirements must be met.

Full VAT Invoices

A full VAT invoice should include:

– Supplier’s name, address, and VAT registration number

– Name and address of the recipient of goods or services

– A unique identification number

– Date of issue

– Time of supply (which may be the same as the date of issue)

– Description and quantity of goods or services provided

– Total amount excluding VAT

– Total amount of VAT

– Price per item excluding VAT

– Rate of VAT charged per item (clearly indicating exemptions or zero-rating)

– Rate of any item-specific discount

Modified VAT Invoices

– Used for retail supplies totalling over £250.

– Includes all the information required for a full VAT invoice.

– Also includes the total amount including VAT.

Simplified VAT Invoices

These are used for retail supplies totalling under £250 and only need to show:

– Supplier’s name, address, and VAT registration number.

– Unique identification number.

– Time of supply (which may be the same as the date of issue).

– Description of goods or services supplied.

– Rate of VAT charged per item (clearly indicating exemptions or zero-rating).

– Total amount including VAT.

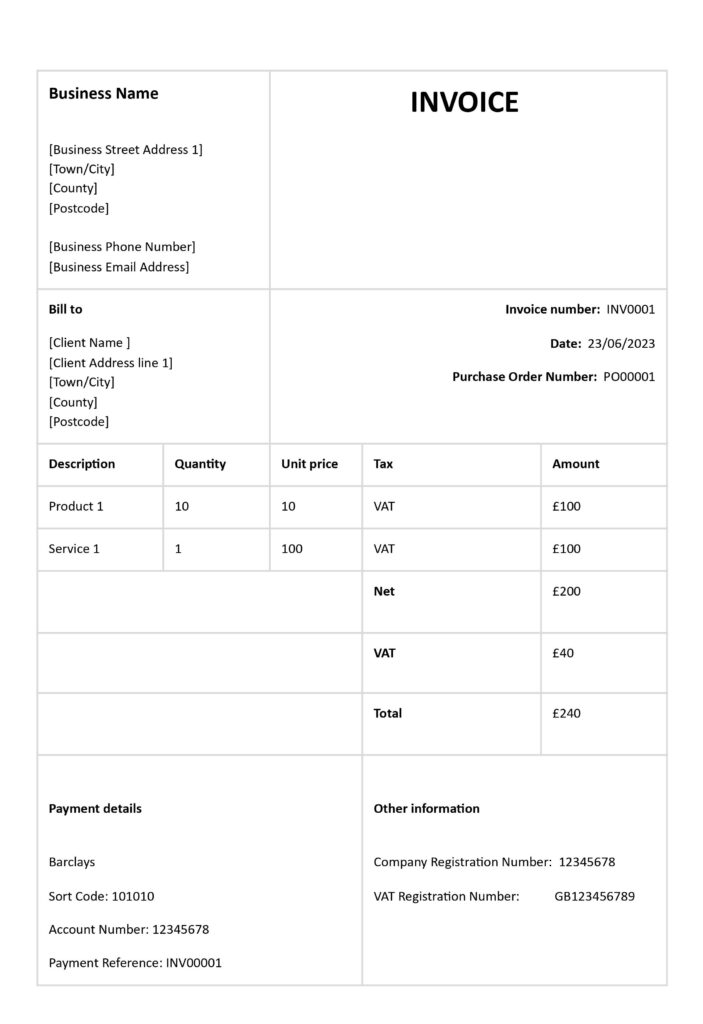

What does a VAT invoice look like?

VAT invoices can be branded or just provide the necessary information in a simple document like the example below:

How long is a VAT invoice valid for?

In the UK, a VAT invoice is considered valid for a period of six years from the date it was issued.

It is crucial to retain and maintain VAT invoices for this duration to ensure compliance with record-keeping requirements and facilitate any potential audits or investigations by tax authorities.

In conclusion

We hope you found our complete guide to VAT invoices useful.

By being aware of the purpose and timing of VAT invoices and adhering to the necessary invoicing requirements, you can streamline your accounting processes, maintain compliance, and foster strong relationships with customers.

How we can help

At CRM Accountants, we are here to assist you in navigating the complex world of VAT invoices.

Whether you require guidance on issuing VAT invoices, interpreting local regulations, or managing your tax obligations, our team is ready to provide personalised support tailored to your business needs.

Remember, accurate and compliant VAT invoicing is a vital component of financial management, ensuring your business remains on the path to success.

If you would like any advice on VAT invoices or any accounting services for your business, you can count on CRM. Fill out our contact form or call 01865 379272.